BEYOND THE NUMBERS

A new Urban Institute report on the economic status and demographic characteristics of Disability Insurance (DI) beneficiaries echoes what we’ve said before in our report and testimony: DI beneficiaries tend to be older and have limited education, modest income, and few assets compared with their non-recipient peers.

Urban’s authors carefully matched survey results to Social Security Administration (SSA) records to examine many variables — such as education, race, marital status, homeownership and other assets, and non-Social Security income — that aren’t obtainable from administrative data alone.

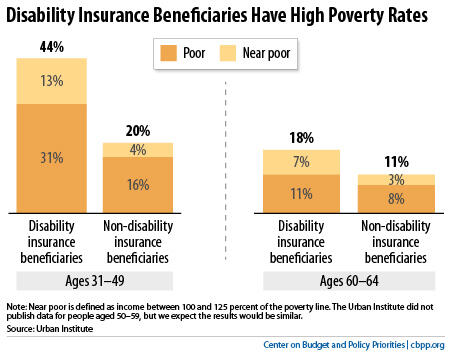

Their findings about poverty rates are particularly striking. Although DI is not needs-tested (unlike Supplemental Security Income, a safety-net program for the very poorest disabled or elderly Americans), DI beneficiaries are nevertheless far likelier to be poor or near-poor than people who don’t collect DI. (See graph.)

Urban’s researchers note that DI benefits are most important to severely impaired older workers with limited education. As we’ve pointed out, people are roughly twice as likely to be disabled at age 50 as at 40, and twice as likely to be disabled at age 60 as at 50.

High school dropouts are about four times as likely as college graduates to receive DI, the authors find. “Adults with relatively little schooling tend to have more health problems than college graduates. They are also more likely to work at highly physically demanding jobs, and thus less likely to remain in the labor force after they develop disabilities,” they explain. That’s why the law specifically directs SSA to weigh whether an applicant’s age and education make it unrealistic for him or her to switch to lighter work — and why high school graduation rates help explain the geographic pattern of DI receipt, too.

DI’s modest benefits chiefly help older workers with severe impairments, high health care costs, limited education and skills, and high mortality. In short, DI works as policymakers intended.