BEYOND THE NUMBERS

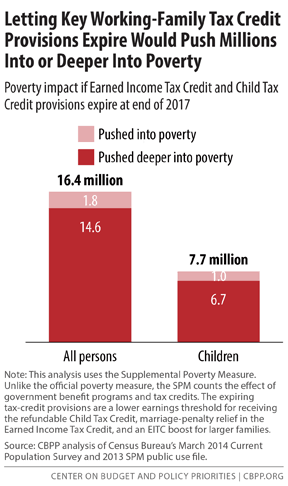

As we’ve explained, the new budget plans from House and Senate Budget Committee Chairmen Tom Price and Mike Enzi would impose deep cuts in programs for low- and moderate-income Americans, exacerbating poverty and inequality. One way they would worsen poverty is by allowing crucial provisions of the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) for low- and modest-income working people to expire at the end of 2017. That would push more than 16 million people, including almost 8 million children, into or deeper into poverty (see chart).

In 2009, policymakers reduced the earnings needed to qualify for a partial CTC, thereby expanding the credit for millions of low-income working families and making other families newly eligible for a partial credit. They also raised the income level at which the EITC begins to phase down for married couples to reduce the marriage penalty some two-earner families face in the EITC. And they boosted the EITC for families with more than two children to help them cover their higher living costs.

If Congress allows these provisions to expire, millions of low-income working families would lose all or part of their EITC and CTC. For example:

- None of the $14,500 in earnings of a full-time, minimum-wage worker would count toward the CTC. The earnings needed to qualify for even a tiny CTC would jump from $3,000 to $14,700. The earnings needed to qualify for the fullCTC would rise from $16,330 to more than $28,000 for a married couple with two children. A single mother with two children who works full time at the minimum wage (and earns $14,500) would lose her entire CTC of $1,725.

- Many married couples would face higher marriage penalties and cuts to their EITC. Currently, to reduce marriage penalties, the income level at which the EITC begins to phase out is set $5,000 higher for married couples than for single filers. After 2017, it would be $3,000 higher than for single parents, which would shrink the EITC for many low-income married filers and increase the marriage penalty for many two-earner families.

- Larger families would face a cut in their EITC. After 2017, the maximum EITC for families with more than two children would fall by over $700.

These provisions are too important to ignore. Making them permanent would promote work, reduce poverty, and support children’s development.