BEYOND THE NUMBERS

Chairman Ryan’s Call for “Welfare Reform, Round Two” Ignores Inconvenient Facts About Round One

House Budget Chairman Paul Ryan said yesterday that his budget aims to begin “welfare reform, round two.” According to Chairman Ryan, “That means block-granting means-tested entitlements — like food stamps, like housing assistance — back to the states so they can customize these benefits, have time limits, work requirements, the kinds of successful policies that made welfare reform so successful.”

But the statistics he cites about welfare reform’s “success” come from the early years of welfare reform, when the unemployment rate was exceptionally low — in April 2000 it fell to 3.8 percent, below what economists consider full employment. Since a safety net is supposed to help people during times of economic need, the true measure of success is how it does during the worst of times, not the best of times. And, 15 years after Congress enacted welfare reform, we can see clearly that it is not the resounding success that Chairman Ryan claims.

The facts speak for themselves:

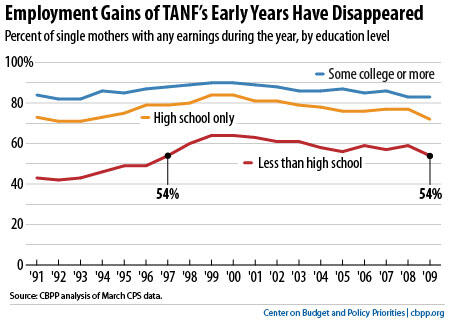

- Fact #1: Single mothers’ employment rose during the early years of welfare reform, but it started losing ground in 2000 and now, nearly all of those gains have been lost. The share of poorly educated single mothers with earnings rose from 49 percent in 1995 to 64 percent in 2000 but has since fallen or remained constant every year. By 2009, it had fallen to 54 percent — the same level as in 1997, which was the first full year of welfare reform implementation (see graph). It remained at 54 percent for 2010.

- Fact #2: Welfare reform contributed only modestly to the rise in employment for single mothers during the 1990s. A highly regarded study by University of Chicago economist Jeffrey Grogger found that welfare reform accounted for just 13 percent of the total rise in employment among single mothers in the 1990s. The Earned Income Tax Credit (which policymakers expanded in 1990 and 1993) and the strong economy were much bigger factors, accounting for 34 percent and 21 percent of the increase, respectively.

- Fact #3: Temporary Assistance for Needy Families (TANF), the centerpiece of welfare reform, helps many fewer poor families than its predecessor, Aid to Families with Dependent Children (AFDC). Welfare reform’s modest contribution to raising employment among single mothers came at a very high price. As our recent report showed, TANF serves only 27 families for every 100 families in poverty, down from 68 families for every 100 families in poverty before welfare reform. Many children face bleaker futures as a result: in 2005, TANF lifted just 650,000 children out of “deep poverty” (that is, raised their family incomes above half the poverty line); ten years earlier, AFDC lifted 2.2 million children out of deep poverty.

- Fact #4: States used their flexibility under TANF’s block grant to undermine, not strengthen, the safety net for poor families. The Great Recession provided the ultimate test of whether states could do a better job than the federal government of providing a safety net for poor families. They failed. The national TANF caseload rose by just 13 percent during the downturn, even though the number of unemployed doubled, and caseloads in 22 states rose little or not at all. In contrast, the national SNAP (food stamp) caseload rose by 45 percent and kept 5 million people out of poverty in 2010 under a measure of poverty that counts non-cash benefits. When the need for cash assistance rose during the recession, states responded by scaling back their TANF programs to save money — shortening and otherwise tightening time limits and reducing already low benefits further, leaving the poorest families poorer.

The real agenda for “welfare reform, round two” should be to fix the failings of round one and build on successes like the TANF Emergency Fund, which states used to place 250,000 people in temporary jobs and provide basic and emergency assistance to many others. It shouldn’t be to extend a failed model to other critical programs.