BEYOND THE NUMBERS

Health reform’s marketplaces launched in every state on January 1, offering individuals and small businesses the opportunity to shop from an array of affordable, comprehensive health insurance plans. Now that the open enrollment for 2014 coverage has closed, states have a chance to fine-tune their plans for next year. A new database that CBPP has launched will give them critical information that they’ll need to make those decisions.

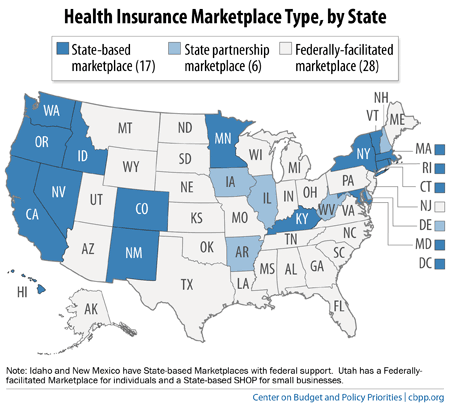

The health reform law gave states the option to establish and operate their own marketplace as a State-based Marketplace (SBM), partner with the federal government through a State Partnership Marketplace (SPM), or defer to the federal government to provide a Federally-facilitated Marketplace (FFM) in the state (see map).

The states that opted to develop their own marketplaces or to partner with the federal government have significant design and operational flexibility to exceed federal minimum requirements and tailor the program to meet state-specific needs.

CBPP has analyzed the 17 SBM and 6 SPM states across a number of design questions as well as best practices. We’ve summarized the findings in a new database that states can use as they work to ensure that their marketplaces meet adequate competition, affordability, accessibility, and customer satisfaction requirements.

Among our key findings:

- Marketplace governance: In an effort to ensure independence in governance and policy setting, avoid conflicts of interest, and ensure long-term viability, 11 states created a quasi-governmental agency to operate their marketplaces. Governing boards composed of experts and key stakeholders oversee the new agencies; the majority of states prohibit insurers and/or brokers from serving on the board.

- Marketplace plan standards: States adopted a variety of innovative standards to enhance competition and affordability, improve value and transparency for consumers, and mitigate the risk of “adverse selection,” under which sicker-than-average people buy marketplace insurance compared with those who enroll outside the marketplaces, which would result in higher marketplace premiums. In fact, several require that issuers offer a standardized plan design to enable consumers to more easily compare plans based on price and provider networks.

- Customer service and website features: States used a variety of interactive web features to provide a customer-friendly application and shopping experience, including allowing consumers to browse plans before creating an online account or submitting an application. Many states also allow consumers to effectively filter and search marketplace results by plan features, including by premium, deducible, co-pays, or provider.

CBPP will continue to collect and update information on each State-based Marketplace and State Partnership Marketplace, and we’ll provide additional analysis to assist states as they institute marketplace policies for the 2015 plan year and beyond.

Click here to access the interactive database.