BEYOND THE NUMBERS

Bernstein: Why Future Budget Deals Must Include New Revenues

As we’ve noted, CBPP Senior Fellow Jared Bernstein told a Senate Budget Committee hearing yesterday that tax expenditure reform offers a useful way forward in the debate over deficit reduction, since it can raise significant revenues while cutting spending that’s administered through the tax code. In this excerpt from his testimony, he explains why new revenues should be a part of future budget deals:

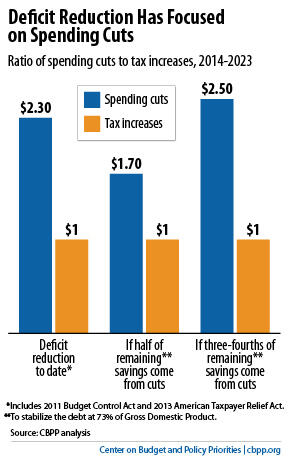

Congress and the Administration worked together to achieve around $2.4 trillion in deficit savings, 2013-2022, including (with interest savings) $1.7 trillion in spending cuts and $700 billion in tax increases. Thus, using just the policy changes (leaving off interest savings) in this recent round of deficit reduction, Congress has so far legislated $2.40 of spending cuts for every one dollar of tax increases. . . .

My Center on Budget and Policy Priorities colleague Richard Kogan has updated these estimates for the most recent budget window, 2014-2023, and also added what it would take to stabilize the ratio of debt-to-GDP (the debt ratio) over that window, an accomplishment I would consider the first step to getting the nation on a sustainable fiscal path. . . . [I]t would take another $1.5 trillion in savings over this period to stabilize the debt at 73% of GDP. . . .

[The chart] shows that ratio of cuts to revenues prevailing so far and the ratio if Congress were to split the needed $1.5 trillion between both budget categories. . . . An even split at this point would still not reach the roughly 1:1 ratio proposed by the earlier [bipartisan deficit] commissions, but it would narrow the ratio some, bringing it to 1.7 to 1. On the other hand, a 75/25 split (cuts to revenues) would result in a less balanced split than the current ratio. . . .

Thus, a balanced plan requires new revenues as part of the deal. I recognize that this flies in the face of a recent partisan position that essentially maintains “we’ve already raised taxes and we won’t do it again.” I believe that the analysis above, using standard, widely-accepted estimates, reveals that position to make no more sense than were partisans on the other side were to say “we’ve already cut spending, we’re not going to do it again.” Achieving our medium-term goal of debt stabilization will require compromise, which in practice implies both new revenues and new spending cuts.