BEYOND THE NUMBERS

We’ve explained that if policymakers don’t extend the temporary cut in the Social Security payroll tax, every paycheck in America will shrink starting next month, slowing next year’s economic growth rate by 0.6 percent, according to Goldman Sachs. The President proposes extending this tax cut for one year or replacing it with something comparable.

An alternative that the Urban-Brookings Tax Policy Center’s Roberton Williams advanced last year deserves a fresh look: bring back the “Making Work Pay” tax credit for one year and double it, for about the same total cost as simply extending the payroll tax cut for one year.

Enacted in the 2009 Recovery Act, Making Work Pay gave workers a credit worth 6.2 percent of their earnings up to $400 for singles and $800 for couples. It phased out between $75,000 and $95,000 (twice that for couples). The credit expired after 2010 and the payroll tax cut essentially replaced it.

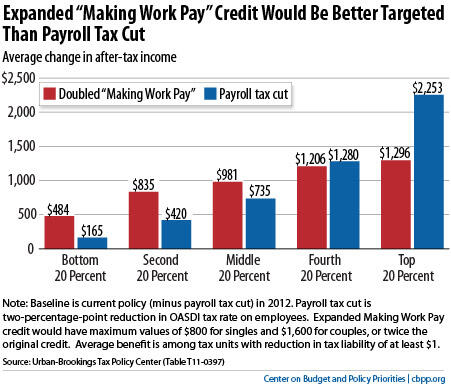

A new Making Work Pay credit worth up to $800 for singles ($1,600 for couples) would cost roughly the same as extending the payroll tax cut. But it would have greater bang-for-the-buck because it would flow more to moderate-income people (see chart), who are more likely to spend rather than save any extra income they receive.

And, because Making Work Pay operates through the income tax, it would put to rest concerns that continuing the cut in payroll taxes — which help fund Social Security — would undermine that program. (As we’ve noted, offsetting contributions to the Social Security trust funds from general revenues have held the trust funds harmless from the reduction in payroll taxes, and this arrangement doesn’t pose a danger as long as it remains strictly temporary.)

If policymakers can’t agree on an expanded Making Work Pay or another equivalent alternative, they should extend the payroll tax cut. The economic risks of letting it expire are just too high.