BEYOND THE NUMBERS

A number of leading liberal lawmakers and policy analysts have long advocated for a stronger Earned Income Tax Credit (EITC) to better assist childless workers — and support for such a step is now growing among conservatives as well, as we explain in our new commentary.

For instance, former George W. Bush economic advisor Glenn Hubbard wrote recently, “Increasing the credit for childless workers to an amount closer to that for families with children would augment the direct work incentive and help counter poverty among the working poor.” Other conservatives have called for strengthening the EITC for childless workers, too, including Lori Sanders and Eli Lehrer of the R Street Institute (a conservative think tank) and the American Enterprise Institute’s (AEI) Michael Strain.

In one sense, conservative support for strengthening the EITC isn’t surprising. This tax credit has enjoyed broad bipartisan support over the years — President Ford signed it into law, and President Reagan lauded the credit and proposed, and signed, a major expansion of it — because the EITC helps low-income people struggling to make ends meet while encouraging work and personal responsibility.

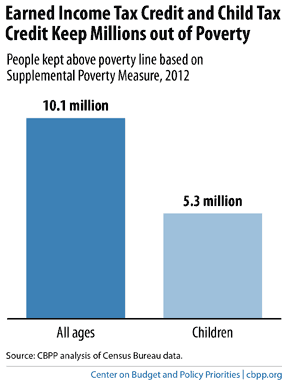

Next to Social Security, the EITC combined with the refundable portion of the Child Tax Credit constitutes the nation’s most powerful anti-poverty program. These two credits lifted 10.1 million people out of poverty in 2012, including 5.3 million children (see chart). As AEI’s Strain points out, the EITC “is a very effective anti-poverty tool because it supplements earnings and incentivizes employment. Expansions of the EITC have been very successful at encouraging work, particularly among single mothers during the 1990s.”

The most glaring hole in the EITC, however, is its almost complete exclusion of childless adults. A childless adult working full time at the minimum wage earns too much to receive the credit. Partly as a result, childless workers are the sole group of workers that the federal tax system taxes into — and in many cases, deeper into — poverty.

For childless workers who qualify for the EITC, the credit is very small, averaging just $270 a year. And the childless workers’ EITC is restricted to workers aged 25-64, so all childless workers under age 25 are ineligible for it. This is unfortunate given the low employment rates among less-skilled young workers and the importance of young people gaining a toehold in the economy.

Of course, how to expand help for childless adults matters. Some conservatives would strengthen the EITC as an alternative to any increase in the minimum wage, a position with which we strongly disagree. Both a strong EITC and an adequate minimum wage are needed to ensure that work “pays” for those in low-wage jobs and thereby to bring more people into the labor force, as we explained in a recent analysis.

But that shouldn’t detract from the apparent emerging consensus that a critical next step to alleviate poverty is to better reward the work of low-income childless adults. It’s time for policymakers across the political spectrum to begin work on this important task.

Click here for the full commentary.