Blog

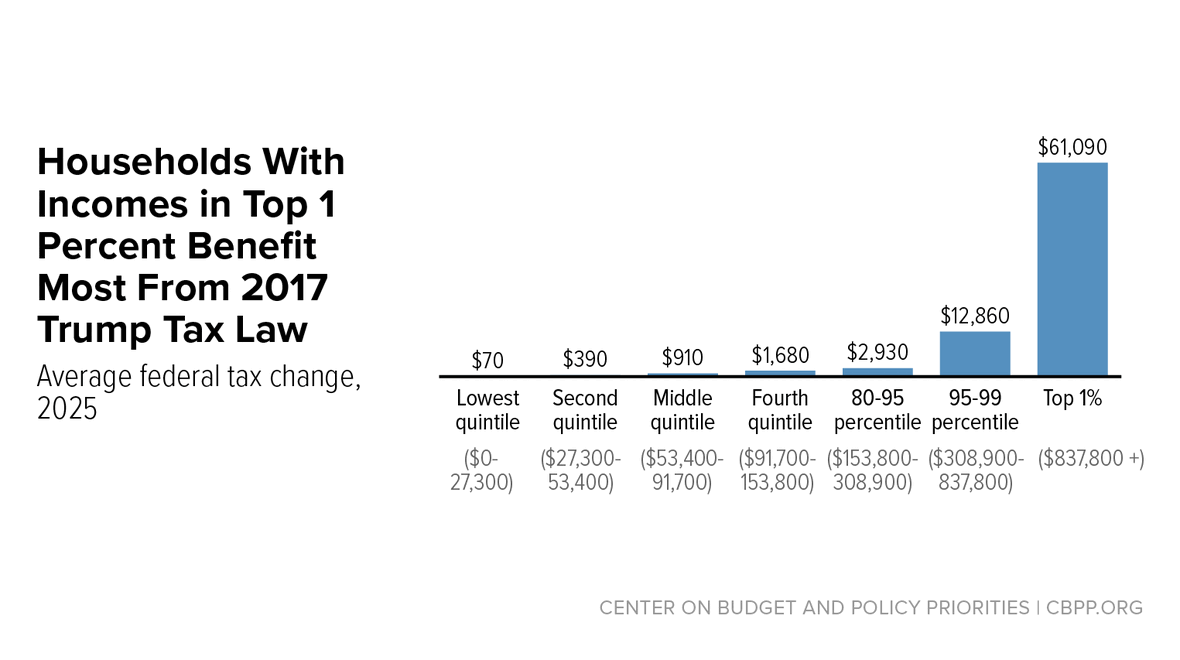

For Tax Day, 7 Charts on the 2017 Trump Tax Law and Why Congress Should Set a New Course

A high-stakes tax debate has begun over the scheduled expiration of the 2017 Trump tax law’s individual income tax and estate tax provisions at the end of 2025. Ahead of this year’s tax day, we...