BEYOND THE NUMBERS

The congressional "supercommittee" that the debt limit deal establishes to recommend more deficit-reduction measures not only can consider revenue increases, but must consider them if it's going to produce a balanced plan. Here are five reasons why:

- President Bush's tax cuts are a significant contributor to projected deficits, as this well-known chart shows. Letting the tax cuts expire would save up to $3.8 trillion over the next decade, not including the savings on interest payments on the national debt.Moreover, claims that we must extend the tax cuts to avoid seriously harming the economy are incorrect. The Congressional Budget Office (CBO) has found that extending the tax cuts would be the least effective of all spending and tax options that CBO examined for boosting the weak economy and creating jobs. CBO also pointed out that permanently extending the tax cuts without paying for them would, on balance, weaken economic growth in the long run because of the large increases in deficits it would produce.

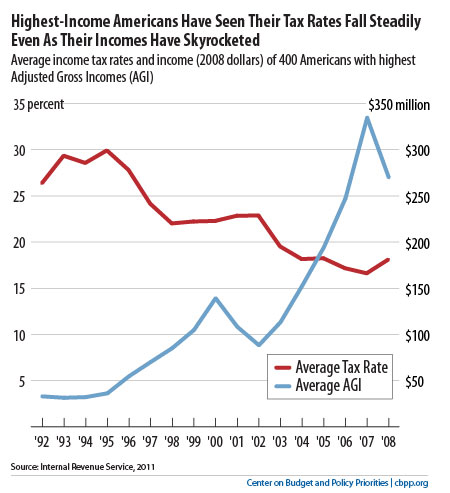

- Higher-income people can and should share in the sacrifices needed to reduce long-term deficits. Elderly Medicare recipients, soldiers, working-class college students, and many others may have to take a seat at the budget-cutting table. Basic fairness dictates that the most affluent people in the country take a seat as well.Over the past couple of decades, taxes on people at the very top have fallen dramatically, even as their incomes have soared. Recent IRS data on the nation's top 400 households — whose incomes averaged $270 million in 2008 — show that the average share of their incomes that they paid in federal taxes dropped from 26 percent to 18 percent between 1992 and 2008, while their annual incomes shot up by over 700 percent, after inflation (see chart). Moreover, many high-income Americans, such as the group Patriotic Millionaires, are willing to help reduce deficits by paying more in taxes.

- Taxes are low both in historical terms and in comparison with other countries. While taxes have fallen disproportionately for high-income people, they also are at or near historically low levels for middle-class people, as we've explained. That's true whether you count just federal income taxes or all federal taxes, including payroll and excise taxes. Moreover, the United States collects less in taxes than nearly any other developed country when measured as a share of the economy, according to data from the Organisation for Economic Co-operation and Development.

- A large chunk of federal spending takes place through the tax code. The federal government spends more than $1 trillion a year on "tax expenditures" — credits, deductions, and other targeted tax breaks. That's more than it spends on either Social Security or on Medicare and Medicaid combined. There's growing bipartisan interest in curtailing tax expenditures to help reduce deficits, and if done right, it could also make the tax code more efficient and equitable. The bipartisan Bowles-Simpson commission, the Rivlin-Domenici task force, and the Senate "Gang of Six" have all recognized tax expenditure reform as a significant source of deficit reduction. The "supercommittee" should do the same.

- Taking taxes off the table would force crippling cuts in entitlement programs. To achieve $1.2 trillion in savings over the next ten years (as the debt limit deal requires) from the spending side alone would require cutting an average of roughly $110 billion annually, starting in 2013. That's more than the federal government plans to spend each year on all of the following combined: the FBI, the National Institutes of Health, the Centers for Disease Control and Prevention, Head Start, and Pell Grants to help students afford college.The large majority of the cuts would presumably come from entitlement programs, since Congress is making roughly $1 trillion in cuts in discretionary programs under the opening phase of the debt limit deal. And, as we've noted :

If the joint committee were only to cut entitlement programs to reach its target, how deep would those cuts be? The deal that President Obama and Speaker Boehner were negotiating several weeks ago would have raised Medicare's eligibility age, raised Medicare cost-sharing charges, shifted significant Medicaid costs to states, modified cost-of-living adjustments in Social Security and other benefit programs (and in the tax code), and instituted other entitlement savings. Those steps would have saved $650 billion to $700 billion over ten years. The joint committee would have to produce cuts twice as deep — and roughly twice as deep as those in the Gang of Six plan.

Fortunately, the supercommittee can avert this outcome by including meaningful revenues in its deficit-reduction proposals.