BEYOND THE NUMBERS

The Daily Beast’s new list of states “most likely to go bankrupt,” the latest example of the widespread misunderstanding of state budget problems, reflects three big problems that we addressed in a recent report. As we explained:

1. States’ budget shortfalls for next year shouldn’t be lumped together with their longer-term budget issues. States are required to balance their budgets each year. Over the past three years they’ve done so despite a plunge in revenues due to the recession, and next year (fiscal year 2012) could be states’ toughest yet.

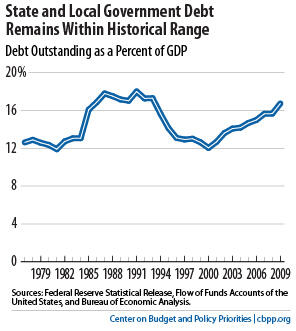

But these are cyclical deficits that will diminish as the economy improves. They are distinct from the longer-term issues — states’ bond indebtedness, pension obligations, and health insurance costs for retirees — that some observers see as evidence of imminent fiscal disaster. States can address these latter issues, whose size many observers have exaggerated in recent months, over the next several decades. It doesn’t make sense to add them to states’ projected 2012 shortfalls and then declare that states are in a crisis too deep for them to handle.

Over the last century, only one state has defaulted on its general obligation debt: Arkansas in 1934, during the depths of the Great Depression. In most states, bonds have the first call on revenues; the state makes required debt service payments before funding any public services.

States do indeed face long-term budget challenges, including revenue systems that need modernization and pension funds that are somewhat underfunded. But there is no evidence that they won’t be able to address these challenges

3. States aren’t interested in walking away from their obligations. As the National Governors Association stated last week, “The nation’s governors strongly oppose federal proposals to provide states with bankruptcy protection. Allowing states to declare bankruptcy is not an authority state leaders have asked for nor would they use.”

States have adequate tools to meet their obligations: spending cuts and revenue increases. Allowing them to declare bankruptcy would give policymakers an excuse not to do the real work of agreeing on the hard spending and revenue choices necessary to keep their budgets in balance. It could also make it more expensive for all states to borrow the funds they need to invest in infrastructure.

The reality, therefore, is that no state is at all “likely” to go bankrupt.